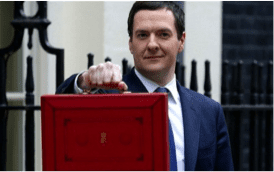

On Wednesday, Britain’s Chancellor George Osborne delivered his first budget of the new parliament and the first all-Conservative budget for 19 years. Freed from coalition and compromise with their former Liberal Democrat colleagues, there was expectant anticipation among political, media and business audiences that this would be the defining budget for the next five years.

Before the May general election, Mr Osborne had seemingly laid out his intentions, warning Britons that his determination to eliminate the nation’s budget deficit was undimmed and that he was still intent on finding £42billion in spending cuts by 2020. It was a tough and uncompromising message; his policy of austerity was not over yet.

Before the May general election, Mr Osborne had seemingly laid out his intentions, warning Britons that his determination to eliminate the nation’s budget deficit was undimmed and that he was still intent on finding £42billion in spending cuts by 2020. It was a tough and uncompromising message; his policy of austerity was not over yet.

But in a dramatic U-turn the Chancellor softened his approach. Buoyed by better than expected economic growth, he has delayed his plan for the UK to reach a budget surplus by an extra year to 2019-20. This means that Britons can expect public spending reductions similar to those endured in the last five years. Painful, but neither faster nor slower. In effect, Mr Osborne has embraced the deficit reduction policy of his predecessor the Labour Chancellor Alistair Darling; but don’t expect Mr Darling to gain any credit.

This was a budget packed full of decisive measures and a ruthless appropriation of policies from other parties. From the announcement of a new national living wage (set at £7.20 per hour), previously one of Labour’s totemic policies, to a further increase in the personal allowance to £11,000, the level at which people start paying tax and long viewed as a cornerstone Liberal Democrat policy; the Chancellor was taking no prisoners.

Ever the political strategist, as well as the nation’s finance minister, Mr Osborne saved his main focus for reshaping the relationship between business and welfare. In an attempt to draw on American comparisons, he cited that his budget offered a ‘new contract’ for the British people. He announced that he will cut the top level corporation tax to 18% by 2020 – giving the UK the lowest corporate tax rate of any major advanced economy and startling in its contrast to the US with a top corporate tax rate of 35%. In return, a levy to fund apprenticeships will be introduced on all large companies and business will be required to pay higher salaries with the new living wage.

But the most controversial measures related to the overhaul of welfare payments and principally in-work tax credits. With pensioners considered too important a segment of the electorate to offend; all their entitlements remain ring-fenced, which means that it is the working age population which takes the brunt of the benefit reductions.

But the most controversial measures related to the overhaul of welfare payments and principally in-work tax credits. With pensioners considered too important a segment of the electorate to offend; all their entitlements remain ring-fenced, which means that it is the working age population which takes the brunt of the benefit reductions.

The Chancellor has been systematic in his reduction in the amount a household can receive in benefit payments, the reduction in eligibility criteria to receive tax credits (a means of a government supported means of assistance for many people on low salaries, reduced from £6,420 to £3,850) and working age benefits (including tax credits and local housing allowance) will be frozen until 2019.

Mr. Osborne wants to reshape Britain. He wants businesses to take more responsibility for training and paying their employees, and persuade those long-term unemployed that the future is much brighter if you are able to secure work and not stuck in benefit dependency. This carrot and stick approach towards welfare claimants has made progress, but at times it has been brutal and there are justifiably concerns that once again it is the low-paid working population that depend on tax credits to support their low wages who will be stripped of much needed support.

The Chancellor has dealt his hand and challenged British business to shoulder its responsibility in reforming and supporting Britain’s workforce through a new settlement. If he succeeds, it may be the great reforming budget he desperately wants it to be, but if he fails, then he will have condemned a significant proportion of low-paid workers to face an even more challenging standard of living, and succeeded in only underlining the view of his critics that this Conservative government really is only interested in protecting the interests of its own supporters.

The stakes on this budget have never been higher for the Chancellor. It will make him or break him.